FTSE 100 CEO pay drops as investors flex muscle during. Supply increased and investors learned there was money to be made by buying and selling bonds in.

Constructing A Corporate Bond Portfolio Using Xtbs

Understanding Bond Prices And Yields

Treasury Bills Guide To Understanding How T Bills Work

Lets look at two examples of what rising inflation and interest rates look like.

How do bond prices work. Bond prices can also fall if investors think there is an increasing danger that they wont get the payments they. The price of the bond adjusts to stay competitive within the market. In turn sovereign bond yields are dropping.

El Salvadors bitcoin bonds plan gets wary reception from fund managers Nov 22 2021. The derivative component of structured notes could be linked to a single stock or an equity index. There is no easy escape from the global debt trap Nov 22 2021.

The 10-yr German bund yield is down six basis points to -033. In the 1970s the modern bond market began to evolve. In this instance the price of the bond would increase to approximately 97087.

Since the interest payment is semi-annual it is going to arrive at 1250 every six months. 25 2021 at 132 pm. In each case there is a guarantee on the bond component.

If all goes well at the end of 10 years the original 1000 will be returned on the maturity date and the bond will cease to exist. Economist Saturday October 23 2021 711 am ECONOMYNEXT Rising prices will hurt the poor in Sri Lanka but controls are have never worked sent wrong signals and cannot be a part of any price stability and poverty reduction program senior economist Sirimal Abeyratne has said. A Moderate Rise in Inflation Interest Rates.

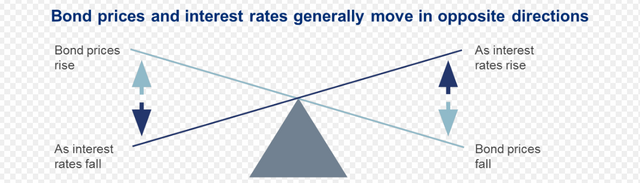

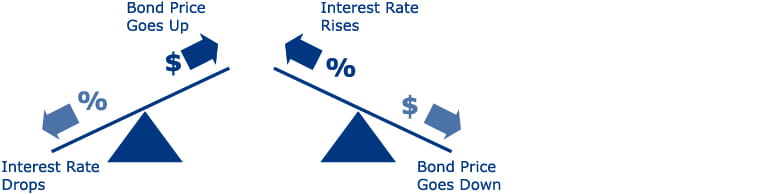

As demand for bonds increases so do bond prices and bondholder returns. When interest rates rise bond prices fall. Bond yields are inversely.

This inverse relationship can seem a little complex at first glance but a chart can give you a better grasp of it. Top Fed official opens door to faster taper of bond-buying programme Nov 19 2021. That brand has become a multi-billion dollar business so much so that Amazon will now partake of the next chapter in the Bond saga following its purchase of MGM reflecting a.

By Stephen Nakrosis. To illustrate why bond prices and market interest rates tend to move in opposite directions suppose you purchased a 5-year 1000 bond at face value that was paying a 7 coupon rate. The performance bond protects against a contractor failing to deliver the work as specified in the contract.

Sri Lankas rising prices will hurt the poor but price controls do not work. On Tuesday said it priced its first sustainability bond offering. Because bond prices and yields move in opposite directions that implies a record high for bond prices as well.

The contract must be specific about the work to. KPRC 2 Investigates reviewed court records of all murder and capital murder cases where the bond was set this year from Jan. When interest rates rise bond prices fall and vice versa.

Government debt rallies as Europe toughens Covid restrictions Nov 19 2021. Global stocks drift lower after renomination of Jay Powell Nov 23 2021. Lagarde and Weidmann clash over how to respond to surging inflation Nov 19 2021.

Why Bond Prices Change When Interest Rates Change. They could also be. US bond bulls hold their ground in face of red-hot inflation Nov 23 2021.

A bond yield is the return you get for a bond over a specific time period. When interest rates go down bond prices increase. Bond connects strengthens and champions a dynamic network of civil society organisations to eradicate global poverty inequality and injustice.

Growthflation takes hold Nov 23 2021. Bond funds are subject to interest rate risk which is the chance bond prices overall will decline because of rising interest rates and credit risk which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuers ability to make such payments will cause the price of that bond to decline. Market Extra Death cross in 10-year Treasury yields signals that bond yields may plumb new depths and prices rally Published.

Brussels seeks to revive capital markets union plans Nov 19 2021. Some structured notes but not all include the entire principal in that bond. Software company Autodesk Inc.

Lets say that inflation and. So bondholders may try to sell pushing bond prices lower and raising the yield. Writing successful proposals is essential to the work of every aid and development organisation.

A small but mighty change to force US corporate climate reform Nov 19 2021. Colgate-Palmolive Prices Inaugural Sustainability Bond 500 Million Offering will support Colgates ambitions to drive social impact help millions of homes and preserve the environment. In at least 10 of the 257 cases we examined.

Bourne and Bond. Each 1000 bond is going to receive 2500 per year in interest. The many different kinds of bonds.

The yield is still low and prices on a historical basis remain quite high. Diverse organisations in our network. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero.

The offering consists of an aggregate principal. In a matter of serendipity it was announced a short time ago that the FDA has approved booster shots with the Pfizer PFE and Moderna MRNA vaccines for all US. More people would buy the bond which would push the price up until the bonds yield matched the prevailing 3 rate.

Now suppose market interest rates rise thereby causing bonds similar to yours to offer say an 8 coupon rate. A discovery bond covers. There are several types of bond yields.

Why Do Bond Prices Go Down When Interest Rates Go Up. It pays to enter Chinas green bond market early before prices take off The lack of greeniums the premium that green bonds can command for Chinas products wont last. A type of fidelity bond used to protect a business from losses caused by employees committing acts of fraud.

These can be used to evaluate a bonds risk and value.

Bond Definition What Are Bonds Forbes Advisor

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Convexity Definition

Bond Prices Rates And Yields Fidelity

How Do Negative Interest Rates Work By Matt Tucker Harvest

How To Calculate Bond Price In Excel

Intermarket Analysis At Work Stocks Vs Bonds Steemit

Allianzgi Bond Price And Interest Rate

1